Extremely convenient and affordable self-paced courses!

Extremely convenient and affordable self-paced courses!

A Certified Internal Auditor (CIA) is the only globally recognized internal audit designation that authorizes them to perform internal audits globally. It is issued to accountants who have passed the three-part CIA exam and met the other requirements. Both the exam and license are issued by the Institute of Internal Auditors (IIA.)

A CIA is usually employed as an employee of a particular company, rather than as external contractors. They responsible for tracking the internal controls of a company and ensuring that its financial reports and corporate governance policies are in line with the country’s laws and regulations.

The CIA is a specialized accounting certification that focuses on internal auditing, rather than other accounting fields. They are specifically trained in reviewing financial records. This means that it is useful for those who would prefer to work for a company rather than an accounting firm. The CIA exam is one of the hardest accounting certification exams to pass, with a pass rate of about 39% – 42% per part. This makes the certification prestigious, which helps with higher salary, demand and promotions.

Additionally, since it is a highly specialized certification, meaning that holding a license indicates that the holder is highly competent and knowledgeable in the field of internal audits. Another major draw is that the CIA certification is an internationally recognized designation, whereas a CPA is only recognized in the US and is only granted on a state of issuance basis and interstate license reciprocity. However, with that said, the CPA license is also accepted in other countries on the basis of international license reciprocity.

In order to take the CIA examination, the candidate will first need to meet the prerequisites. Minimally, this entails meeting the educational requirements, providing character references, passing the three parts of the CIA exam, as well as meeting the CIA experience requirements. Once this is done, the candidate can submit proof of fulfilling these requirements and can then apply for certification.

An ‘Active Internal Audit Practitioner’ designation can be earned thorough a approved Internal Audit Education Partnership (IAEP) school.

The CIA exam is divided into three parts, each of which entirely comprise of multiple-choice questions. The exam parts can be taken in any order, but all parts must be passed within a three-year timespan, or the earlier results will expire, and the candidate will need to retake it.

The exam parts vary in length as follows:

To pass, a candidate must score at least 600 out of 750 possible marks per part. The CIA exam is available in over 13 languages, including English, Spanish, Arabic, Chinese (simplified), Chinese (traditional), Korean, Portuguese, German, French, Japanese, Russian, Thai and Turkish.

It is recommended to put in around 55-95 hours of preparation per exam part. There are many online courses and mock exams online that you can use to study for the exam.

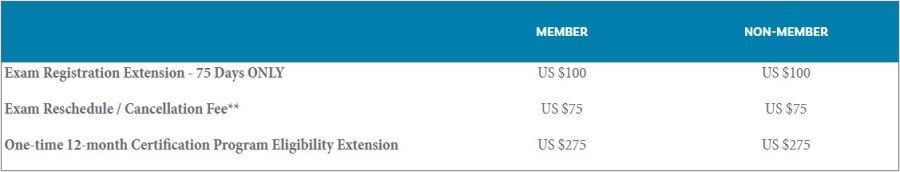

Once you have registered for an exam part, you will have 180 days in which to take it. It costs $100.00 USD to extend the window, if need be.

According to Indeed.com, the average salary for an internal auditor in the United States is around $75,520 USD, with the salary of a CIA with less than a year of experience being $75,770 USD and for someone licensed for more than 10 years being around $94,430 USD.

Yes, a CIA needs to renew their certification annually by December 31st. This includes meeting the annual CPE requirements of either 40 hours for an active certificate holder or 20 hours for an inactive certificate holder, and paying the membership fee. At least 2 of the CPE hours need to be earned from an IIA-approved CPE course provider. Failure to renew your membership and to meet the CPE requirements will result in the certifications expiration. In order to reactivate the CIA certification, you will need to complete a reinstatement form, pay the necessary fees and provide proof of meeting CPE requirements for meeting the CPE requirements of the last 12 months. These CPE hours will not be counted towards the current year’s requirements.