New! Amazing Self-Paced Courses You Can Start Every Month!

One of the most daunting aspects of the CPA exam is the reports of the pass rates of the CPA exam and the implications of that. Here, we will provide an overview of the pass rates from 2020 to 2021, in order to look at how they’ve changed over the years, and to provide insight as to what shifts caused these changes.

The Uniform CPA is a four-part exam that qualifies the applicant for CPA licensure once all four sections have been passed with a score of at least 75 each within an 18-month time span. These sections comprise of the Auditing & Attestation (AUD), Financial Accounting & Reporting (FAR), Business Environment & Concepts (BEC) and Regulation (REG) exams. This license allows the license holder to legally practice public accountancy, meaning that they can perform certain auditing and taxation functions that other accountants cannot, such as to represent their clients before the IRS and to sign tax documentation. It is known for being extremely hard, which is why a CPA license is viewed as being prestigious.

The American Institute of Certified Public Accountants (AICPA) was founded in 1887, under the name ‘American Association of Public Accountants (AAPA)’ in order to regulate accountancy practices in the US. It was then changed its name in 1917. This was when it first began offering the service of providing state accountancy boards with a CPA exam and grading them on their behalf, starting with Kansas, New Hampshire and Oregon. This was also the year that they teamed up with the National Association of State Boards of Accountancy (NASBA.) It became a CPA-exclusive society in 1936 when it merged with the American Society of Certified Public Accountants. The AICPA slowly attracted the other states and jurisdictions and then changed its name to its current name in 1957.

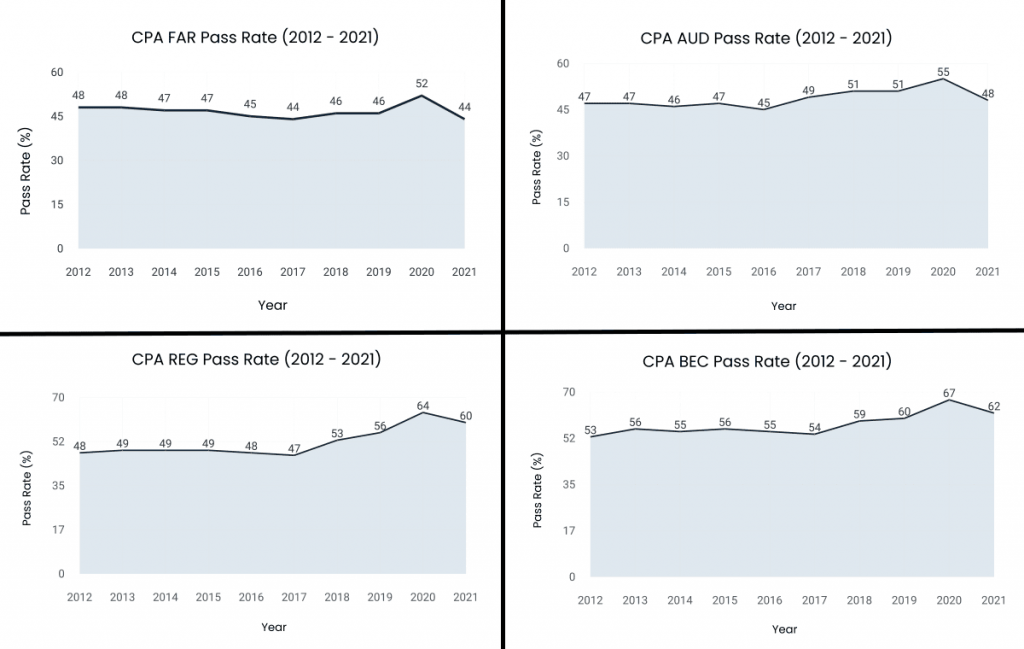

As you can see from the graphs, the annual results were fairly consistent until 2018, when they suddenly increased. The reason for this was that the exams were updated that year. Although the content of the exam is regularly adjusted, this was more of a format-based change. After gathering feedback from hundreds of CPAs, they decided to alter the content of the exams so that they would test the examinees’ higher order thinking skills, such as their evaluation and analytical skills, over just demonstrating their recollection of knowledge.

The reason AICPA chose to adopt this approach, was because they agreed with the feedback that the ability to memorize content often did not translate well into practical skills once the CPA entered the workforce. Therefore, they attempted to adapt the exam so that it would better illustrate that the candidate was able to apply their knowledge to a variety of applications, think creatively and that they actually understood the principles that they had learned. Most of the content changes were implemented in the Financial Accounting and Reporting (FAR) and Business Environment and Concepts (BEC) sections of the exam.

As we can see, 2020 marked a significant increase in CPA pass rates. This is unsurprising given all of the changes that occurred with the students, exam and testing processes as a result of the pandemic. Firstly, there were the lockdowns, which gave aspiring CPAs with plenty of time to focus on their studies and grinding MCQs. Next, there was the AICPA’s decision to implement exams throughout the year instead of only four times a year. This allowed applicants the freedom to take the time they needed to prepare for their exam without the fear of running out of time through a lack of test dates. Finally, the implementation of CPA exams in international Prometric testing centers also meant that a wider variety of applicants could take the exam and again at their own pace without having to stress about air ticket costs, accommodation and trying to jam all of their exams into a small window to try avoiding additional costs.

2021 was when the world returned to relative normalcy, as people were able to return to college campuses and on-site work. Of course, there were the occasional lockdowns, but not like in 2021. This meant that people needed to adjust back to commuting times, meeting deadlines and balancing their social life again, which likely caused the results to drop back to around where they were in 2019.

A CPA license is equated with high-level skills, focus, dedication and knowledge. It needs to be difficult in order to ensure that those who pass have sufficiently internalized the extensive information that they are expected to know, and to ensure that the CPA license remains respectable. If it were too easy to pass, then it would lose much of its value in the eyes of both employers and clients, as well as run the risk of having insufficiently educated or unskilled individuals represent clients for taxation which could result in severe financial repercussions to the client, and possibly the CPA as well.